The 7-Second Trick For Pvm Accounting

The 7-Second Trick For Pvm Accounting

Blog Article

The Basic Principles Of Pvm Accounting

Table of ContentsThe Ultimate Guide To Pvm AccountingThe Single Strategy To Use For Pvm AccountingGetting The Pvm Accounting To WorkThe Basic Principles Of Pvm Accounting Getting The Pvm Accounting To WorkPvm Accounting - The Facts

Supervise and handle the production and approval of all project-related billings to consumers to foster great interaction and stay clear of problems. construction accounting. Make certain that ideal records and documentation are sent to and are upgraded with the IRS. Make sure that the audit procedure follows the legislation. Apply required building accountancy requirements and procedures to the recording and reporting of building activity.Interact with various financing companies (i.e. Title Firm, Escrow Firm) pertaining to the pay application process and requirements required for repayment. Help with executing and maintaining internal monetary controls and procedures.

The above declarations are meant to describe the general nature and level of job being executed by people assigned to this classification. They are not to be understood as an exhaustive list of duties, duties, and skills called for. Workers may be called for to do responsibilities outside of their regular obligations once in a while, as needed.

Not known Details About Pvm Accounting

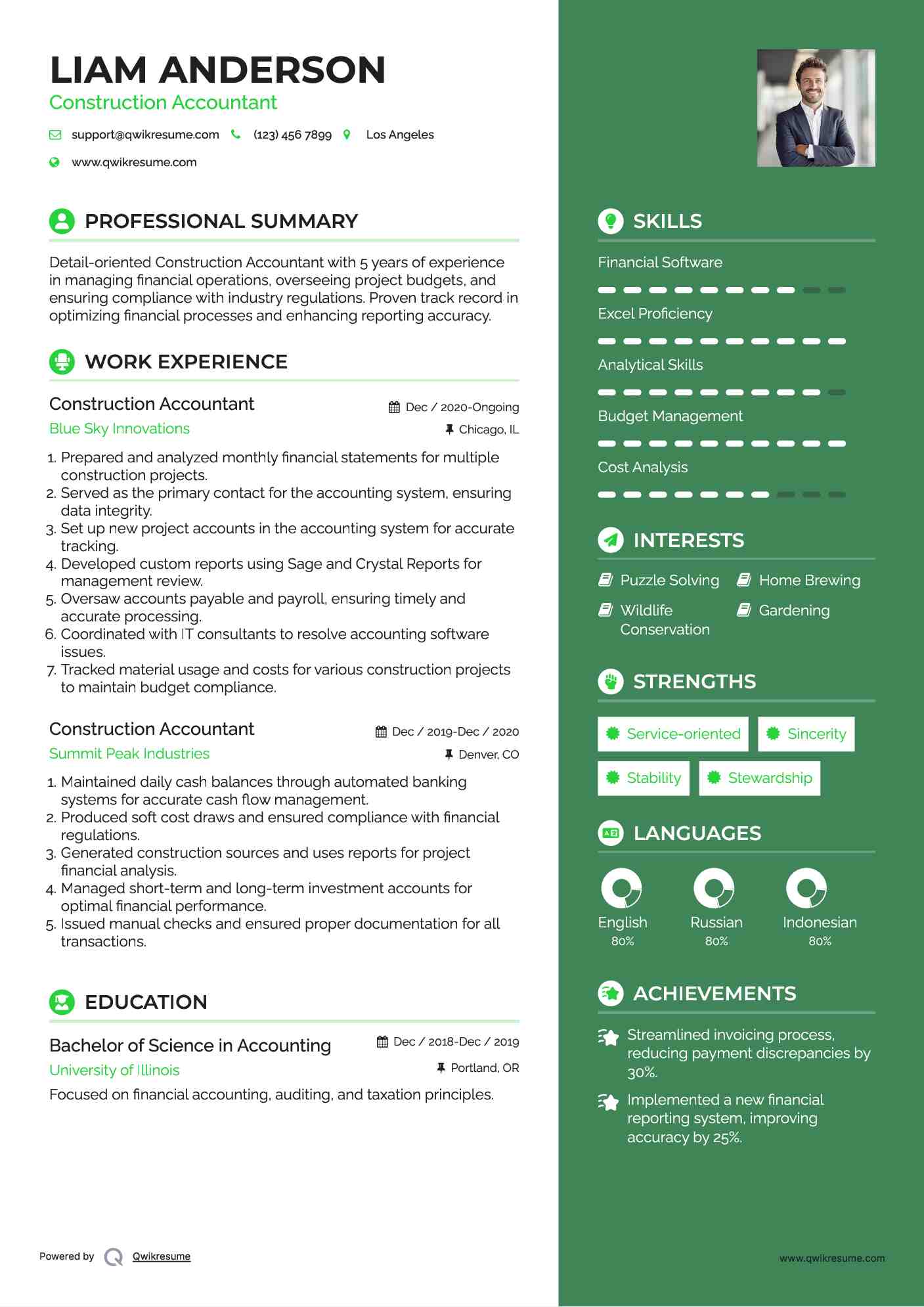

Accel is seeking a Building Accounting professional for the Chicago Workplace. The Building and construction Accountant performs a selection of accounting, insurance compliance, and task management.

Principal duties include, but are not limited to, managing all accounting features of the business in a prompt and precise way and giving records and timetables to the company's certified public accountant Company in the prep work of all economic declarations. Makes certain that all bookkeeping procedures and functions are managed precisely. Responsible for all monetary records, payroll, banking and daily operation of the accounting function.

Prepares bi-weekly test balance reports. Functions with Job Supervisors to prepare and post all monthly billings. Procedures and concerns all accounts payable and subcontractor settlements. Produces monthly wrap-ups for Employees Compensation and General Liability insurance policy costs. Generates month-to-month Task Cost to Date records and collaborating with PMs to reconcile with Job Supervisors' budget plans for each task.

The 45-Second Trick For Pvm Accounting

Proficiency in Sage 300 Building And Construction and Property (previously Sage Timberline Office) and Procore construction administration software program a plus. https://fliphtml5.com/homepage/dhemu/leonelcenteno/. Must likewise be proficient in various other computer system software application systems for the preparation of records, spread sheets and other audit evaluation that may be required by administration. Clean-up accounting. Must possess solid business abilities and capacity to focus on

They are the monetary custodians that make sure that building and construction projects remain on budget, abide by tax regulations, and maintain financial transparency. Building accounting professionals are not simply number crunchers; they are critical companions in the construction process. Their main function is to handle the monetary facets of building tasks, ensuring that sources are alloted successfully and economic threats are decreased.

What Does Pvm Accounting Mean?

By preserving a tight hold on task finances, accounting professionals help stop overspending and economic problems. Budgeting is a keystone of successful building and construction projects, and construction accounting professionals are instrumental in this respect.

Browsing the complex web of tax check that laws in the building and construction industry can be difficult. Building and construction accountants are skilled in these regulations and guarantee that the job follows all tax obligation demands. This consists of handling pay-roll taxes, sales taxes, and any other tax obligation commitments specific to construction. To master the function of a building and construction accountant, individuals need a solid academic structure in audit and finance.

Additionally, accreditations such as Cpa (CPA) or Certified Building And Construction Industry Financial Specialist (CCIFP) are very pertained to in the sector. Functioning as an accounting professional in the building and construction sector includes a distinct set of challenges. Construction tasks usually entail limited due dates, transforming laws, and unanticipated costs. Accountants must adapt rapidly to these obstacles to keep the project's financial wellness undamaged.

The 3-Minute Rule for Pvm Accounting

Ans: Building and construction accountants develop and keep an eye on budgets, recognizing cost-saving chances and ensuring that the job stays within budget plan. Ans: Yes, building and construction accountants take care of tax conformity for building and construction jobs.

Intro to Building And Construction Accountancy By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Building and construction companies need to make difficult options amongst numerous monetary choices, like bidding on one job over an additional, picking financing for materials or devices, or establishing a project's profit margin. Building and construction is a notoriously unpredictable industry with a high failure rate, slow-moving time to repayment, and irregular cash flow.

Common manufacturerConstruction organization Process-based. Production entails repeated procedures with conveniently recognizable costs. Project-based. Manufacturing requires various procedures, products, and equipment with varying prices. Repaired area. Manufacturing or production happens in a single (or numerous) controlled places. Decentralized. Each task takes place in a brand-new area with varying site problems and unique difficulties.

Pvm Accounting Fundamentals Explained

Durable partnerships with suppliers reduce arrangements and boost performance. Irregular. Regular use various specialized contractors and distributors impacts performance and capital. No retainage. Repayment arrives completely or with normal settlements for the complete contract amount. Retainage. Some portion of settlement might be kept until project conclusion also when the professional's work is finished.

While standard producers have the benefit of regulated environments and enhanced manufacturing processes, building firms need to continuously adapt to each brand-new task. Even rather repeatable projects require adjustments due to website problems and other aspects.

Report this page